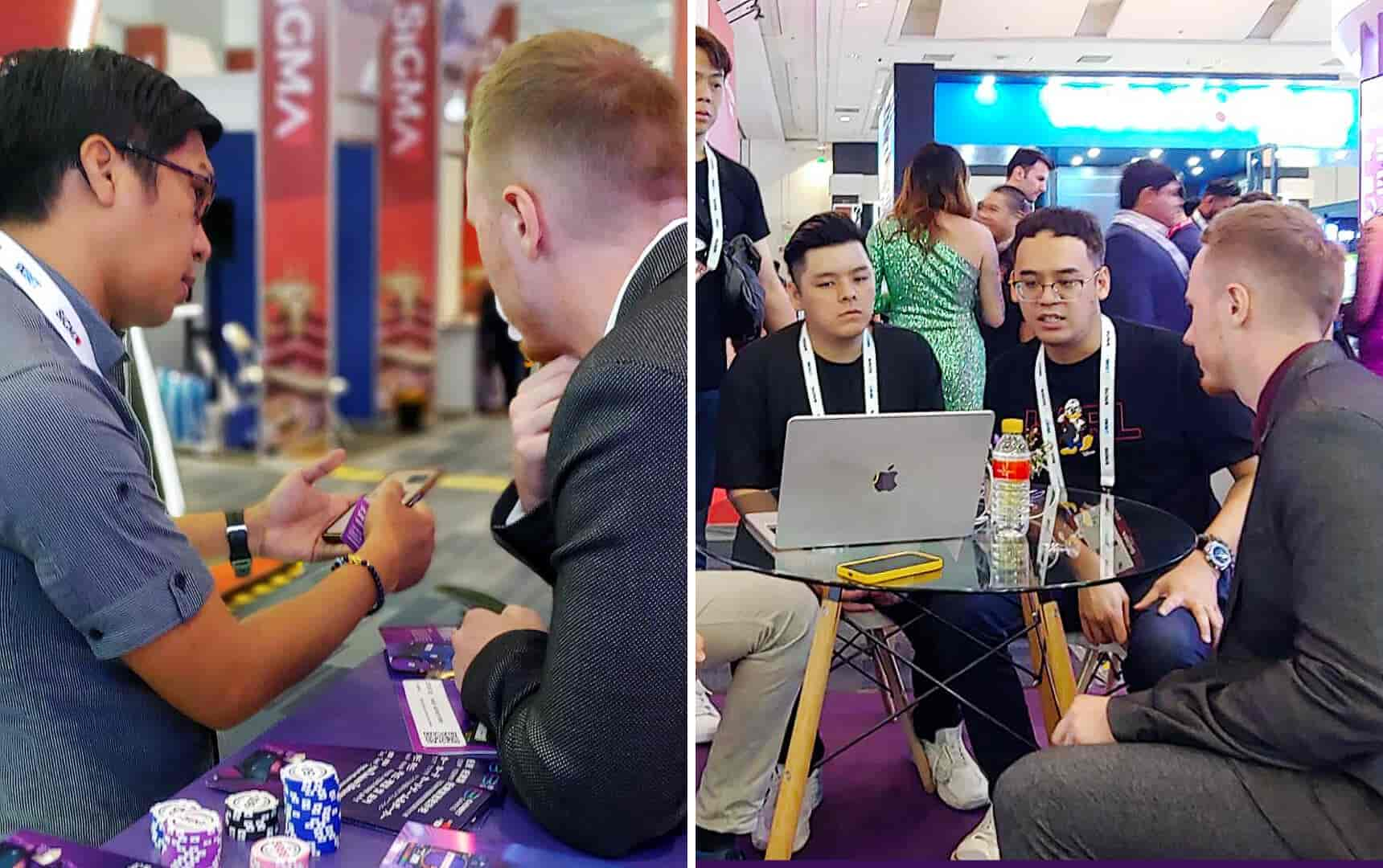

In July 2023, EvenBet Gaming’s marketing team attended one of the major iGaming industry events in Asia – SiGMA Asia, in the Philippines. This event provided an excellent opportunity for our team to conduct insightful interviews with participants, shedding light on prevailing trends and challenges within the Asian iGaming sector. Presented here is a concise report summarising our findings, with more comprehensive insights expected in an updated white paper by the close of 2023.

Adjusting to Asian Peculiarities

When European companies venture into foreign markets, particularly in different continents, the discourse invariably centers around the need for localisation and tailoring of products to fit the local market. This rule remains paramount.

Our experience at the SiGMA Asia event exposed us to unexpected reactions from local firms. To our surprise, the initial responses to our questionnaire were somewhat negative, with respondents either declining to share their views or expressing a desire to fill in the answers by themselves without additional discussions.

This posed a challenge, given that our interviewers employed an electronic form on their iPhones – an embodiment of the current technological era. This mismatch hindered effective interaction and yielded unsatisfactory outcomes.

Swift adjustments were essential, and customising our interview approach became imperative to ensure we gained valuable insights from participants within the Asian iGaming realm.

The remedy came in a simple yet impactful transformation:

- Transitioning to paper-based questionnaires granted respondents autonomy in engaging with the questions.

- Bilingual questionnaires featuring both English and Chinese versions facilitated comprehension and response.

- Acknowledging the cultural distinction, we withdrew from deeply personal conversations, which is often customary when interviewing Europeans.

What differentiates Asia from Europe – the secrets of a localised approach

These adaptations led to a remarkable shift in outcomes, with participants now more inclined to engage in interviews.

This shift has brought reflection:

- Why do these subtle adjustments hold such significance?

- What differentiates Asia from Europe, making it necessary to recalibrate the established approaches by European entities?

Revelations after the adjustments

- Trust and communication. In Asia, an individual with a European appearance may be perceived as a stranger, eroding trust. Establishing personal connections is vital. It’s demonstrated by the conventional Asian practice of initial personal interaction before proceeding to digital exchanges – a pivotal aspect for success.

- Community is the compass. Asian societies value community as a fundamental principle. Decisions are often made collectively, which we underscored at the beginning. This collective perspective extended to the survey, as some participants discussed questions within their teams, leveraging their native language for clarity.

- Linguistic barriers. The language barrier looms large. Learning Chinese is a monumental endeavour for many Europeans, just as English proficiency remains a concern for Chinese respondents. The provision of a Chinese translation addressed this concern, significantly enhancing communication.

Dominant Trends in Asia in Q3 2023

Remarkably, two prevailing trends gained equal emphasis from over 50% of respondents in the Asian market. Both emanate from the intense competition:

- Rapidly evolving technology: fierce competition drives innovation, leading to novel game mechanics, innovative in-game interactions, and streamlined, lightweight games.

- Intensive marketing focus: escalated competition requires increased marketing efforts to capture audiences effectively.

Additional trends, ranked by frequency of mentions, include:

- Integration of crypto-friendly technology, crypto payments, and peer-to-peer options.

- Advancements in AI integration and AI platforms.

- Enhanced customer service provisions.

- Organisation of exclusive events to cultivate business relationships.

Notably, only one participant identified Regulation and Licensing as a shared industry trend.

Focal points of the companies

Our survey unveiled that 40% of respondents prioritise marketing and sales expansion, targeting Asia and Southeast Asia.

Another 24% concentrate on technological enhancements such as better design, user-friendly UX, lightweight games development for targeting the audience in countries with bad Internet connection (Vietnam, Nepal, the Philippines), and adding new entertaining tools to casino games.

Further focal points encompass video games, crash games, sportsbooks, bingo, cloud services, and OTC/Futures.

Challenges: the most pressing issues

The audience was divided into four nearly equal groups, identifying the following challenges:

- Regulatory concerns, negative perceptions of gambling, and unfamiliarity with online gaming.

- Intense competition: an influx of white-label entries, digitisation of land-based casinos, and a continuous increase of new games.

- Player acquisition and introduction of games to Asian operators.

- Inadequate local internet infrastructure.

Some companies identified no serious difficulties, while others highlighted concerns such as recruitment, payment gateway stability, and investor engagement.

Marketing in focus

The primary avenues for effective marketing were selected as follows:

- Social media. Approximately 60% of participants highlighted the paramount role of social media, with Facebook and TikTok being the most frequently leveraged platforms. YouTube also received mention.

- Events. About 52% of respondents recognised events as pivotal for marketing efforts.

- Digital marketing, sponsorships, and outdoor advertising were mentioned, although by a smaller number of companies.

Top digital entertainment types in the iGaming

Survey participants disclosed diverse post-work entertainment preferences, with 16% favouring YouTube and movies.

Another 12% leveraged the Internet exclusively for professional purposes.

In the realm of gaming, no singular trend emerged, with a wide spectrum of activities, including slots, live games, poker, card games, sports betting, fish games, FPS games, and various online gaming options.

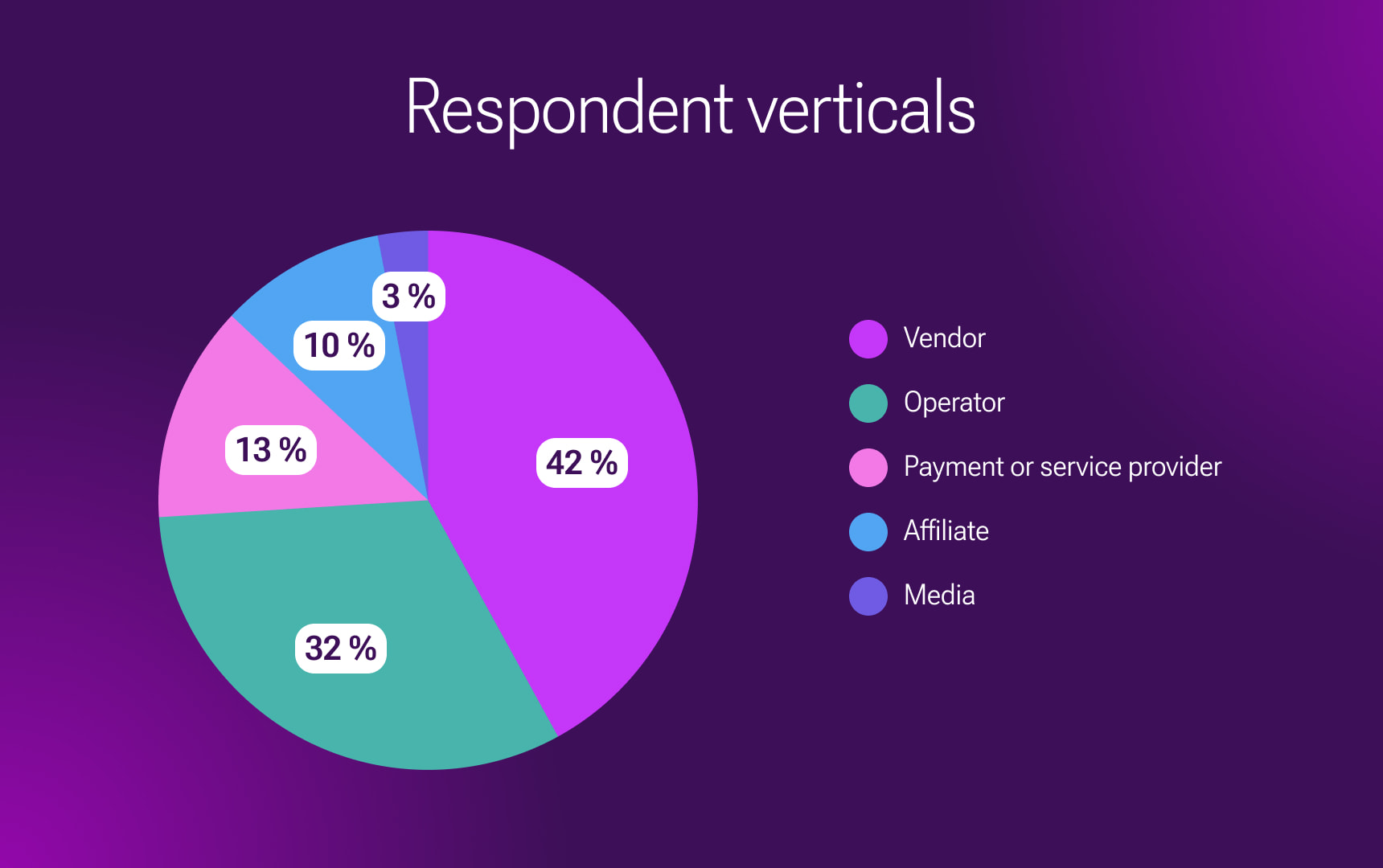

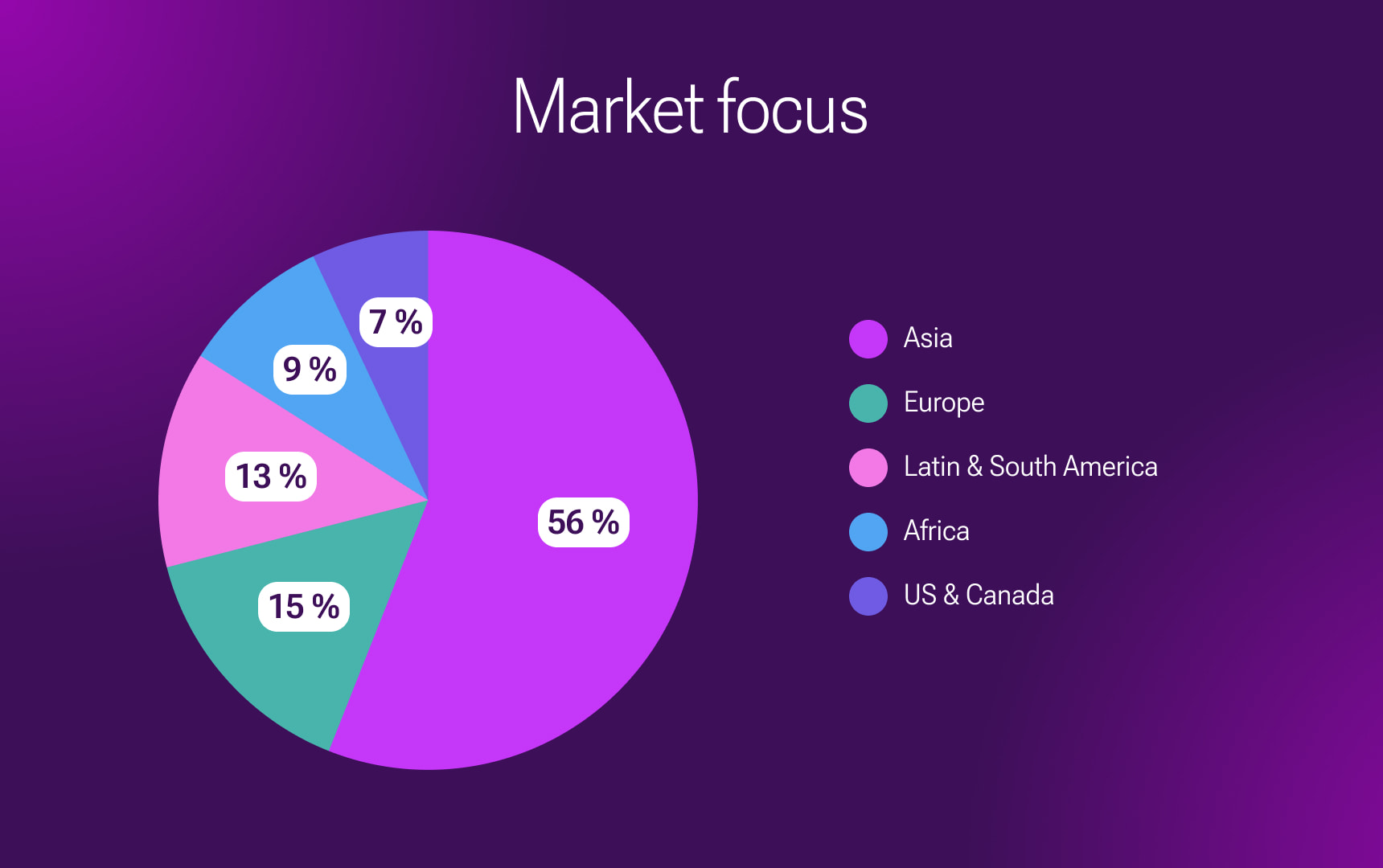

The white paper kind heroes: profiling

Upd: 1 August 2024

Upd: 1 August 2024