Across Asia, online gambling regulation remains one of the most fragmented and fast-evolving elements of the digital economy. While the global iGaming industry moves steadily toward legalization and oversight, the Asian region presents a patchwork of contrasting approaches—from full-scale regulatory frameworks to complete prohibition.

There’s a global trend toward fully legal operations in iGaming. It’s not just a moral issue — the risks associated with gray and black markets are extremely high. Running illegal gambling operations is considered a serious crime, and beyond losing your money and business, you could also lose your freedom for a good ten years. Unfortunately, the Philippines is the only country in the Asian region where online gambling is fully legal and governed by a well-established, nationwide regulatory framework.

The rest of Asia is far from static. Several countries are making moves—some gradual, some ambitious—that are reshaping the regional iGaming landscape. Whether through proposed legislation, enforcement actions, or shifts in public policy, these developments are worth watching closely.

In this article, we offer a country-by-country snapshot of the current legal status of online gambling in Asia. Whether you’re a platform provider, an operator, or an investor considering market entry, this guide will help you understand the challenges, opportunities, and ongoing developments that define the regulatory landscape across the region in 2025.

The Legal Status of iGaming in the Philippines

Until recently, the Philippines operated a dual licensing system for online gambling:

- the Philippine Inland Gaming Operator (PIGO) license,

- the Philippine Offshore Gaming Operator (POGO) license.

The POGO license allowed companies to offer gambling services to players outside the country. However, this scheme was officially phased out in 2024 amid rising regulatory concerns. The Philippines has doubled down on PIGOs—shifting from offshore-driven growth to a more sustainable, regulated online gaming model geared toward local players.

Despite the elimination of the offshore program, the domestic iGaming market in the Philippines continued to grow. In 2024, gross gaming revenue (GGR) increased by nearly 25% year-over-year, reaching $7.16 billion.

At last year’s SiGMA Asia event, there was a notable presence of operators targeting markets where online gambling remains largely illegal. This year, following the POGO ban, the landscape had visibly changed: there were fewer offshore-focused operators.

In Q1 2025, a new wave of regulatory reforms began. Most notably, the tax rate for licensed operators was reduced from 35% to 30%—a rare move in an industry where taxes tend to only go up. At the same time, PAGCOR announced plans to introduce tighter oversight for iGaming providers, signaling a broader shift toward regulating the entire value chain.

The country’s GGR for 2025 is projected to reach between $7.9 billion and $8.5 billion.

Gambling Regulation in Thailand

For some time, Thailand has been viewed as the next potential iGaming market to follow in the footsteps of the Philippines. That optimism gained momentum with the near-finalization of the “Entertainment Complex Act,” a legislative effort to legalize large-scale integrated resorts. The act was expected to come into force in Q1 2026, paving the way for destination casino resorts in key cities including Bangkok, Pattaya, Phuket, and Chiang Mai.

However, on the 9th of July 2025, the Thai government voted to withdraw the bill after its suspension had been announced eight days previously. This has become a huge setback for the gambling regulation in the country. Optimistic voices insist that the act could still be approved after it is revised (especially as the potential resorts are backed by investments already), but the timeframes and conditions are uncertain.

In parallel, lawmakers were also reviewing proposed amendments to the 1935 Gambling Act, which would, for the first time, legalize online gambling in the country. However, industry observers remain cautious about the timeline, especially after the latest news on integrated resorts. The prevailing view is that online regulation is unlikely to move forward until after the integrated resorts are fully built and operational. Even if they are finally legalized, this will take years.

Given the significant foreign investment already committed to land-based casino developments, the government is unlikely to authorize an online framework that could cannibalize that revenue stream before the IRs begin generating returns. For now, Thailand remains a market to watch—but patience will be essential.

Legality of Gambling in Sri Lanka

Sri Lanka’s gambling industry has long operated under a fragmented and outdated legal framework. However, a sweeping legislative overhaul is now underway with the drafting of the Gambling Sports Regularisation Act.

This new bill aims to establish a centralized regulatory authority with oversight of the entire gambling ecosystem—including land-based casinos, lotteries, betting operations, online gambling, and even offshore gaming activities on cruise ships and within the Colombo Port City special economic zone. Industry analysts believe that, once enacted, this law could pave the way for a framework similar to the Philippines’ former POGO system.

Several complementary policy measures are being introduced alongside the legislation. In 2025, the government proposed raising the land casino entrance fee for players from $50 to $100 and increasing the gross turnover tax on casinos from 15% to 18%. At the same time, Sri Lanka is actively courting foreign investment for large-scale projects, including the integrated resort City of Dreams in Colombo Port City.

Interestingly, the 2025 national budget already reflects expectations of increased revenue from the gambling sector — underscoring the government’s intent to formalize and capitalize on what has traditionally been a loosely regulated industry.

Japanese Gambling Laws

Japan is a technologically advanced country with a large, affluent population, which makes it highly attractive to iGaming operators. A report on the state of the gambling market in Japan, presented at the SiGMA Asia conference, drew significant attention and served as one of the sources for this article.

Japan’s legal gambling framework is narrowly defined and tightly regulated. Legal forms of gaming include

- horse racing,

- boat racing,

- auto racing,

- bicycle racing,

- national and sports lotteries,

- pachinko,

- land-based casinos.

Casinos are legal strictly within integrated resort (IR) zones, such as the upcoming MGM Osaka and Genting Yokohama projects.

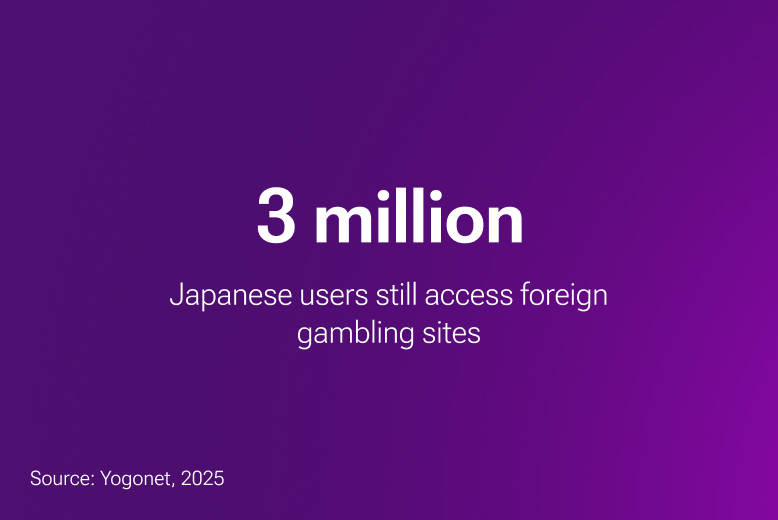

Online casinos, however, remain strictly illegal. Despite this, early 2020s studies showed that approximately 3% of the Japanese population—around 3.37 million people—had gambled online at least once, with 1.97 million reported as active players. Annual wagering volumes were estimated at ¥1.2 trillion (roughly $8.2 billion USD).

The Japanese government has treated this as a growing concern, largely attributing the problem to a lack of public awareness. In 2022, it launched a national awareness campaign that led to a wave of media scrutiny dubbed the “Media Witch Hunt.”

In September 2023, a popular YouTuber was arrested for live-streaming online casino gameplay—the first high-profile case in what became a broad crackdown. Since then, celebrities linked in any way to online gambling—even through casual mentions—have lost endorsements, faced investigations, and in some cases, arrest. The campaign has received widespread media coverage.

By 2025, surveys showed that public awareness had climbed to 90%, with 86% of respondents learning about the illegality of online casinos through news outlets and television.

Still, Japan’s gray-market online gambling sector continues to thrive. Offshore operators target Japanese players through international websites, influencer marketing, and ad platforms outside the country’s jurisdiction. An estimated 3 million Japanese users still access foreign gambling sites.

In response, the Japanese government has urged authorities in eight countries—including Canada, Malta, and Curaçao—to block gambling websites aimed at the Japanese market. A new domestic law is also in development, which would authorize the blocking of any Japanese website containing links to offshore casino operators.

Is Online Gambling Legal in India?

As of late 2025, real-money online gambling is effectively prohibited across India at the federal level.

In August 2025, the Indian government passed legislation that bans all online games involving monetary stakes, including both chance-based and so-called “skill-based” games such as poker and rummy. This marked a sharp departure from the previous state-by-state regulatory approach, where certain states like Sikkim and Nagaland had issued local licenses for limited online gaming activities.

Under the new law:

- All real-money iGaming operations are considered illegal nationwide

- Platforms offering such services to Indian users face criminal liability

- Enforcement applies regardless of whether the operator is based in India or abroad

While casual gaming and esports remain unaffected, the legal environment for online gambling is now explicitly restrictive, and the market is no longer considered a viable or compliant target for iGaming operators.

India is now classified as a black market jurisdiction for real-money online gaming.

Legality of Gambling in Indonesia

Indonesia, with its massive population, is an attractive target for online gambling operators. Countless casino websites cater specifically to Indonesian players—but all such activity exists on the black market. Under Sharia-based national laws, all forms of gambling are strictly illegal.

In mid-2024, the Indonesian government launched a dedicated online gambling eradication task force with the stated goal of eliminating unlawful betting platforms. Between October 2024 and April 2025 alone, authorities blocked over 1.3 million gambling-related websites and froze more than 5,000 associated bank accounts.

Penalties for engaging in illegal gambling in Indonesia are severe, with individuals facing up to 10 years in prison. The country remains one of the most tightly regulated—and aggressively enforced—jurisdictions in the region when it comes to gambling policy.

Gambling Laws in Malaysia

Malaysia allows legal land-based casinos and licensed lotteries, but regulation is strict—Muslims, who make up the majority of the population, are prohibited from participating in gambling activities. Online gambling, meanwhile, is illegal and largely exists in a gray area. Many Malaysians continue to access offshore gambling sites, despite restrictions.

However, the growing popularity of online gambling has prompted Malaysian authorities to reconsider their stance. In May 2024, Prime Minister Anwar Ibrahim announced the government’s intention to review the country’s core gambling laws. The goal is to create a more comprehensive regulatory framework that would enable authorities to better oversee and control all forms of gambling, including online operations.

Gambling Regulation in South Korea

South Korea maintains one of the most restrictive gambling frameworks in Asia. Aside from government-run lotteries and limited sports betting, South Korean citizens are permitted to gamble in only one land-based casino—Kangwon Land. All other casinos in the country are open exclusively to foreign tourists.

Adding to the tight restrictions, the South Korean government also prohibits its citizens from gambling abroad. Violations can lead to prosecution, even for gambling activity conducted outside national borders. Nevertheless, the Philippines is one of the most popular travel destinations for Koreans, partly because gambling is legal there.

Online gambling is entirely illegal in South Korea, with authorities maintaining strict enforcement against both domestic operators and citizens attempting to access foreign sites.

Legality of Gambling in Vietnam

Vietnam permits several land-based casinos, primarily located within resort zones. However, access to these casinos is generally restricted to foreign nationals; local residents are barred from participating in most cases.

Citing social concerns, the Vietnamese government has explicitly prohibited the licensing of online card games and other “casino-style” games. Existing online gaming licenses are limited and typically cover only simple, casual-style games. As a result, Vietnam’s online gambling landscape remains highly restricted, with no legal framework in place to support full-scale iGaming operations.

Conclusion

Asia offers immense potential for iGaming growth—but no universal playbook. Each country brings its own legal, cultural, and economic context, requiring tailored strategies from operators and software providers alike.

As we’ve seen, the Philippines continues to lead with a well-defined and actively evolving regulatory model, while countries like Thailand and Sri Lanka are making strides toward legalization. In contrast, markets such as Indonesia and South Korea remain heavily restricted, with strict enforcement policies in place.

For businesses looking to enter or expand in Asia, staying informed about legal frameworks isn’t just a compliance matter—it’s a competitive necessity. Understanding where each market stands today is the first step toward building a responsible and successful operation tomorrow.

Upd: 19 December 2025

Upd: 19 December 2025