The iGaming industry has been rapidly expanding across the globe, with emerging markets playing a pivotal role in its growth. These markets, which have not yet reached full maturity, offer significant opportunities for operators willing to navigate the challenges of new and evolving territories. They are characterised by a variety of factors that make them ripe for growth, including rising internet penetration, an expanding middle class, and evolving regulatory frameworks.

General Characteristics of Emerging Markets in iGaming

Key Drivers of Growth

- Increased Digital Connectivity: Many emerging markets are seeing a surge in internet and smartphone penetration, providing the infrastructure needed for online gambling to flourish. As more consumers come online, iGaming platforms are finding a larger, more engaged audience.

- Rising Middle Class: Economic growth is fostering the development of a middle class with higher disposable incomes. As people have more financial flexibility, recreational activities like online gambling are becoming more accessible, particularly in Southeast Asia, Africa, and Latin America.

- Untapped Audience: Emerging markets often feature large, untapped populations that are new to iGaming. Operators have the opportunity to build brand loyalty early, gaining a foothold in regions where the market is still developing.

- Favourable Demographics: With younger, tech-savvy populations, these markets are ideal for online entertainment. The demand for mobile-first gaming experiences is growing, especially as smartphone adoption continues to rise.

- Evolving Regulations: While regulations are still in development in many emerging markets, several regions are starting to establish clearer legal frameworks for online gambling. This regulatory clarity helps reassure operators and fosters a more stable environment for growth.

Promising Regions

- Africa: With a young, tech-savvy population and growing internet access, Africa holds significant promise for iGaming. Countries like Nigeria and South Africa are leading the charge, but regulatory hurdles remain a challenge for many operators.

- Southeast Asia: Southeast Asia is rapidly emerging as a key market, particularly countries like the Philippines and Vietnam. Although regulations vary by country, the growing popularity of online gambling, especially in sports betting, positions this region for growth.

- Latin America: Latin America’s online gambling market is expanding rapidly, especially with countries like Brazil and Mexico showing strong interest in sports betting. Despite regulatory differences, the region’s football culture and rising middle class provide solid growth potential.

- Eastern Europe: Eastern Europe, with countries like Romania and Serbia, is experiencing a surge in online gambling, particularly in sports betting and online casinos. As regulations continue to evolve, operators are finding new opportunities in this region.

Emerging markets are a treasure trove of opportunities for iGaming operators, with growing populations, increasing disposable incomes, and expanding digital infrastructure. By understanding the unique dynamics of each region and adapting offerings to meet local demands, operators can capitalise on the potential for long-term success.

Challenges and Considerations for Operators in Emerging Markets

While emerging markets offer exciting opportunities, they also come with their own set of challenges. Regulatory uncertainty, local competition, and the need for tailored content are among the key obstacles operators must navigate. Additionally, payment systems and financial inclusion can be significant barriers in some regions, requiring operators to offer flexible payment solutions and adopt innovative methods for customer acquisition and retention.

Operators looking to expand into these markets must also stay attuned to the cultural and legal nuances of each region. A deep understanding of local consumer behaviour, preferences, and regulatory requirements is critical for success.

Let’s take a closer look at the situation using the example of three countries from different regions of the world: the Philippines, Brazil, and Serbia.

Online Gambling in the Philippines

The Philippines has emerged as a prominent force in the global iGaming industry, cementing its reputation as a key player in the Asia-Pacific region. The sector has experienced substantial growth, driven by technological advancements, shifting consumer behaviours, and strong government support.

The iGaming Boom in the Philippines

The iGaming sector has become a vital contributor to the Philippine economy, generating significant government revenues, creating thousands of jobs, and attracting foreign investments. Taxes and licensing fees collected from the industry support various social and economic programs, underscoring its critical role in national development.

The global pandemic acted as a catalyst for the iGaming industry, accelerating the shift to online platforms. Players increasingly embraced digital gaming options, leading to a surge in participation and revenue.

It should be mentioned that gambling is deeply ingrained in Filipino culture. For instance, it is common to place bets and play various money games during wakes. The proceeds from such gambling often go to the bereaved family as financial support.

Traditional Casinos vs. iGaming

While online gaming has flourished, traditional land-based casinos face mounting challenges. In the first half of 2024, land-based casinos in the Philippines generated ₱99.2 billion ($1.7 billion) in gross gaming revenue (GGR), a slight dip compared to previous years. Casinos operated by the Philippine Amusement and Gaming Corporation (PAGCOR) under the Casino Filipino brand recorded an 11.6% decline in GGR, attributed to:

- The Online Shift: Many players now prefer the convenience of online gaming platforms.

- Operational Restrictions: Health and safety protocols have limited physical casino operations.

- Heightened Competition: Online gaming’s rapid growth has intensified competition.

Despite these challenges, brick-and-mortar establishments remain essential players, especially high-end integrated resorts attracting international visitors.

The launch of an online casino under the Casino Filipino brand is expected soon. Initially scheduled for Q1 2024, it was later postponed to Q4. However, as of the time of writing, the project has not yet been launched.

Regulatory Landscape

PAGCOR continues to play a pivotal role as both regulator and operator. Recent regulatory changes have reshaped the market:

- Reduced Fees for E-Games Operators: Lower costs have attracted new entrants and fostered expansion.

- Streamlined Licensing: Easier processes have encouraged competition and innovation.

- Responsible Gaming Measures: Stricter regulations have enhanced the industry’s credibility.

- POGO Ban: The order to cease Philippine Offshore Gaming Operator (POGO) activities by the end of 2024 is a major development, shifting the focus towards domestic markets.

The POGO ban, while significant, comes with challenges, including potential revenue losses of ₱20 billion ($343 million) annually and job displacement for up to 30,000 workers. However, it also alleviates regulatory burdens linked to monitoring illegal activities previously associated with POGOs.

PAGCOR, in turn, promises to offset the financial losses from the POGO ban by increasing the industry’s investment appeal.

Emerging Trends in iGaming

Mobile Gaming

The rise of smartphones has transformed the iGaming experience in the Philippines. Operators are adopting a mobile-first approach, offering games that are accessible, engaging, and culturally relevant. Features like social gaming elements and localised content have further driven player engagement.

Blockchain

Blockchain technology and cryptocurrencies are slowly making their mark in the Philippine iGaming sector. These innovations promise transparency, faster transactions, and enhanced security, though regulatory scrutiny remains high to ensure consumer protection.

Social Gaming

Research shows that integrating social features into games increases player engagement and retention.

Localisation

While English is one of the official languages of the Philippines, not all citizens are proficient in it. According to surveys, 80% of the population can understand written and spoken English. This is a significant number, but for the majority of people, the native language is Filipino. Experts have noted a growing trend in the popularity of games that are translated into it.

Julia Panina, Head of Product Marketing at EvenBet Gaming:

Hiring local specialists in new territories who are genuinely invested in your company’s success is essential. However, be wary of individuals who claim to be experts without the appropriate credentials.

Gambling Tourism

The Philippines is considered Asia’s premier gambling hub. Unlike neighbouring countries such as Malaysia, Indonesia, and Thailand — where gambling is largely prohibited — the Philippines offers a thriving, legalised gambling industry. The country’s casino tourism is driven by wealthy players from China, Japan, South Korea, and Southeast Asia. Chinese high-rollers, in particular, play a significant role in propelling the industry’s growth.

Manila’s Entertainment City is the epicentre of this booming sector, boasting world-class integrated resorts like Solaire Resort & Casino, Okada Manila, and City of Dreams Manila. These complexes blend high-end gambling facilities with luxurious accommodations, gourmet dining, and premium entertainment, offering visitors an all-inclusive experience reminiscent of Las Vegas.

The economic impact of gambling tourism is evident in the sector’s robust performance. For example, City of Dreams Manila generated $42 million in revenue in 2023, showcasing the immense profitability of the Philippine casino market.

Investment Opportunities

The Philippine iGaming market presents promising avenues for investment:

- E-Games and Online Platforms: The sector’s rapid growth offers opportunities for new and existing operators.

- Technology Infrastructure: Improved connectivity and mobile technology can further support industry expansion.

- Integrated Resorts: High-end resorts in locations like Entertainment City continue to attract substantial investment.

- Skill-Based Gaming: Games blending chance and skill are gaining traction, offering opportunities for developers.

Starting from January 1, 2025, licensing fees for land-based casinos will decrease from 35% to 30%, and for resort operators also operating online, to 25%. Additionally, the tax on GGR will be reduced from 55% to 35%, further enhancing the investment appeal of the gambling industry in the Philippines.

The Philippine iGaming industry is poised for sustained growth. According to Statista, online gambling revenue is projected to reach $680 million in 2024 and $744 million in 2025, reflecting the sector’s resilience and adaptability. The successful navigation of regulatory changes, technological advancements, and consumer trends will be critical to maintaining this trajectory.

As the only regulated jurisdiction in Southeast Asia, the Philippines serve as a gateway to the region’s online market. The country holds immense untapped potential, positioning itself to attract numerous investors to the online gambling industry.

Online Gambling in Brazil

Brazil’s iGaming market is an emerging giant in the global gambling industry, teeming with potential for operators and suppliers. As regulatory frameworks take shape, the market offers immense opportunities despite the challenges of a transitioning landscape. Here’s an in-depth look at the current state and future outlook of online gambling in Brazil.

Brazil Gambling Regulation

As Brazil gears up to launch its regulated online gambling market on 1 January 2025, the country’s authorities have introduced a comprehensive regulatory framework that is reshaping the industry. Some operators have announced their exit from the market due to strict regulations, while others view early compliance as a competitive advantage.

Julia Panina, Head of Product Marketing at EvenBet Gaming:

When Brazil announced that companies could apply for licenses, approximately 80 companies were already operating in the market. These early entrants likely had an advantage over those that launched immediately after the announcement. Notably, the number of companies in the market doubled within four months after the bill was signed.

The Secretariat of Prizes and Betting (SPA) is central to Brazil’s regulatory framework, tasked with promoting fair competition, protecting consumers, and ensuring tax compliance. It mandates a non-refundable licensing fee of R$30 million (approximately $5.2 million), payable within 30 days. Operators must also prove financial stability, matching the fee with paid-up share capital and providing documentation to verify the origin of their funds.

Brazil has implemented robust measures to protect players:

- Bans on Social Welfare Betting: Players cannot use social benefits for gambling.

- Strict Advertising Rules: Gambling ads targeting underage audiences and promising easy profits are strictly banned.

- Promotion Restrictions: Bonuses and registration offers are banned until the market officially launches.

- Fixed-Odds Betting: The odds should be determined at the moment of placing the bet.

The Ministry of Finance has recently blocked an additional 1,812 unauthorised gambling domains, bringing the total to over 5,000. This crackdown sends a strong message: only compliant operators with a Brazilian gambling license will be allowed to operate.

Brazil Online Gambling Market Overview

The surge in online gambling has diverted significant funds from traditional consumption. For families in the lower-income classes, gambling now accounts for 76% of their leisure and culture expenses and 5% of their food budgets, as reported by Strategy&. This reallocation of funds has reduced spending in other sectors, with 37% of gamblers admitting to redirecting money from essential expenses to gambling.

Brazil’s gambling market size is rapidly growing. According to Statista, online gambling revenue in Brazil is projected to be US$2.39 billion in 2025 and over US$4 billion in 2029.

- Massive Population Base: With over 210 million residents, Brazil is South America’s largest country, offering a vast and untapped audience for online gambling.

- Increasing Internet Penetration: Around 70% of Brazilians now have internet access, equating to roughly 147 million potential online users.

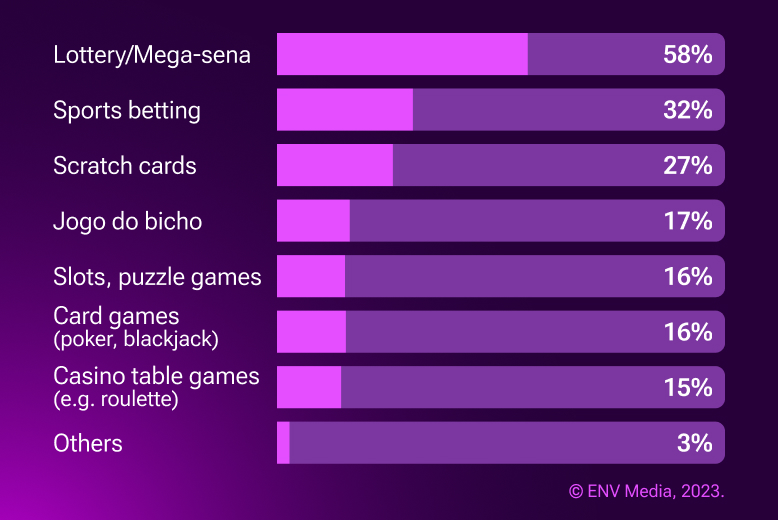

- Cultural Affinity for Gambling: Gambling is deeply rooted in Brazilian culture, with lotteries, poker, and sports betting among the most popular activities.

- Economic Potential: Despite recent challenges, Brazil’s expanding middle class presents a growing market with disposable income for entertainment, including iGaming.

The immense popularity of sports in Brazil, particularly football, cannot be underestimated. This also has a significant economic impact: over the past three years, the online betting market has grown by 734% and continues to expand rapidly.

Poker also deserves a mention. Online cash games were prohibited for a long time, but poker culture continued to thrive. Poker is regarded as a sport, and Brazil has hosted grand offline tournaments for many years. Club poker is currently very popular. By the way, Brazil is one of the key markets for which EvenBet added the Mystery Bounty format to its poker platform, a feature that enjoys massive demand among local players.

The Profile of Gamblers in Brazil

A recent report from Brazil’s Central Bank sheds light on the demographics and spending habits of the nation’s gamblers, revealing significant trends in online gambling participation.

The majority of gamblers in Brazil fall within the 20-to-30-year age range, with an estimated 24 million people engaging in online gambling during the study period. Notably, 17% of participants in the government’s Bolsa Família programme — a social welfare initiative — were involved in gambling activities as of August 2024.

Monthly spending on gambling varies widely, with younger participants typically wagering around BRL 100 (€16.44) and higher rollers spending over BRL 3,000 (€493.48). This spectrum of spending highlights how gambling attracts individuals across different economic strata.

The report emphasises the vulnerability of low-income families to online betting. In August 2024 alone, over 5 million Bolsa Família beneficiaries transferred a staggering BRL 3 billion (€493.5 million) to gambling platforms. Many in this demographic see gambling as a potential way to improve their financial situations, which exacerbates their risk of falling into financial hardship.

Game Preferences of Brazilian Players

1. Roulette in Brazil

Roulette reigns supreme in Brazil, offering a blend of excitement and strategy. Whether it’s European, American, or French roulette, players enjoy the thrill of watching the wheel spin, making it the top choice for casino enthusiasts.

2. Blackjack in Brazil

Blackjack holds a strong second place, attracting those who appreciate the balance of luck and strategy. It’s a preferred table game that allows players to challenge the house or each other.

3. Slots in Brazil

Slots continue to dominate the gambling scene, from classic three-reel games to innovative video slots with intricate features. Their simplicity and the potential for big wins make them an enduring favourite among Brazilians.

4. Poker in Brazil

Poker is bolstered by Brazil’s historically lenient regulation of skill-based games. Its mix of strategy and competition keeps it a popular choice among serious players.

5. Live Dealer Games in Brazil

Live dealer games have gained immense traction, appealing to Brazilians’ love for social interaction. These games combine the thrill of live-action play with the community feel of online gaming, creating a vibrant gaming culture.

Investment Opportunities in Brazil’s iGaming Sector

As the market matures, opportunities abound:

- Sports Betting Platforms: With sports deeply ingrained in Brazilian culture, particularly football, operators can capitalise on this lucrative segment.

- Casino Games Expansion: The anticipated regulatory framework will open doors for innovative and localised casino offerings.

- Technology Infrastructure: Investments in internet connectivity and mobile platforms will further bolster market accessibility.

- Skill-Based Gaming: There’s growing interest in games blending chance with player skill, offering unique avenues for differentiation.

Brazil’s iGaming market is on the cusp of a transformative era. The anticipated regulations will bring clarity and stability, paving the way for exponential growth. For operators and investors, the time to establish a foothold is now, ahead of the January 2025 regulatory milestone.

Online Gambling in Serbia

Serbia, with its rich history and evolving regulatory framework, is carving its niche in the European iGaming industry. From the introduction of casinos in 1964 to the recent regulation of online gambling, the Serbian market presents unique opportunities and challenges for operators and investors alike.

The Legal Landscape

The regulatory framework in its current form was formed in 2020, incorporating common rules for advertising, responsible gaming, and anti-money laundering (AML) policies. A rulebook was introduced by the Games of Chance Administration (GCA) to govern gambling advertisements, ensuring they do not target minors and include warnings about gambling addiction.

The gambling industry in Serbia is jointly managed by several governmental bodies:

- Games of Chance Administration (GCA): It handles licensing, regulation enforcement, and AML compliance. It also evaluates prize funds, monitors live TV lottery draws, and oversees employee training.

- Tax Department of the Ministry of Finance: This department ensures compliance with tax laws, audits financial transactions, and monitors timely tax payments.

- Ministry of Defence: Uniquely involved in Serbia, this ministry examines gaming equipment and software in certified laboratories to ensure integrity.

Companies must be registered in Serbia or within the European Economic Area (EEA) to qualify for a license. However, the licensing process in Serbia is straightforward and investor-friendly, making it an attractive market for operators.

Key licensing requirements include:

- Minimum share capital of €250,000

- Bank deposit or guarantee of €300,000

- Daily risk cash deposit of €10,000

Fees:

- Land-based casino license: €500,000 annually

- Online casino license: €2,500 per month

In a notable move, 40% of government revenue from gambling is allocated to the Red Cross, highlighting Serbia’s commitment to social responsibility.

It is worth mentioning that there is the Association of Gaming Operators of Serbia (AGOS), which focuses on responsible gambling and combating unfair gaming practices. The association’s work aims to ensure that iGaming remains a healthy and socially responsible form of entertainment. Recently, EvenBet Gaming also joined AGOS.

Game Preferences of Serbian Players

Serbia’s iGaming market is a dynamic landscape, reflecting the country’s passion for sports and growing interest in online gambling. From football betting to poker tournaments, each vertical offers unique opportunities for operators and investors seeking to capitalise on this evolving market.

1. Sports Betting in Serbia

Sports betting reigns supreme in Serbia, driven by the nation’s enthusiasm for sports. Football, in particular, leads the betting scene, with its deep cultural significance and history of notable achievements. A defining moment in Serbian football was the 2006 World Cup, when the Serbia and Montenegro national teams advanced past favourites like Spain, cementing their legacy in the sport.

Basketball also enjoys a strong following, buoyed by the consistent success of the Serbian national team. Recent milestones include reaching the semi-finals of the 2024 Paris Olympics and earning multiple FIBA EuroBasket medals. These achievements sustain high levels of interest in basketball betting.

With approximately 1,300 sports betting shops operated by 20 companies, sports betting is not just an online phenomenon but also a prevalent physical activity. This extensive network is complemented by robust online platforms, ensuring bettors have seamless access to their preferred games.

2. Poker in Serbia

Poker has carved out a significant niche in Serbia, bolstered by an active and passionate community. The 2010 membership of Poker Saves Srbije in the International Federation of Poker marked a turning point, enabling Serbian players to engage with the global poker ecosystem.

Match Poker tournaments, organised regularly across the country, provide players with opportunities to hone their skills and foster camaraderie. Despite poker’s popularity, the Serbian government enforces strict regulations. Players are prohibited from participating in offshore or unlicensed platforms, and the government actively blacklists illegal sites to protect the integrity of the market.

3. Casino Games in Serbia

While casino games maintain a loyal audience in Serbia, they remain secondary to the dominant sports betting market. This preference aligns with the country’s active sports culture, where individuals not only play a wide range of sports but also enjoy betting on events they follow. Football and basketball remain the primary focus of these wagers.

The casino landscape is bolstered by a mix of online platforms and land-based establishments, providing players with a variety of options to suit their preferences. However, the casino sector is still overshadowed by the fervour surrounding sports betting.

4. Horse Racing

Horse racing occupies a niche position in Serbia’s iGaming market. However, it is managed exclusively by the state-owned Konjički Savez Srbije.

Current Trends and Challenges

The iGaming market in Serbia has faced mixed outcomes in recent years. In the first half of 2024, the market size contracted by 9.9% year-over-year, accompanied by a 6.6% drop in new player acquisitions. However, operators achieved a 3.6% revenue increase, signalling better monetisation of existing players.

Despite current challenges, Serbia’s iGaming sector shows promise. According to Statista, online gambling revenue is projected to reach US$155 million by 2025 and grow to US$186 million by 2029. This growth is likely to be driven by regulatory improvements, enhanced player experiences, and innovative operator strategies.

EvenBet Gaming operates worldwide. On all continents inhabited by people, there are projects running on our software. The company has accumulated 20 years of experience in conducting business in various regions of the world, including localising products into local languages and considering regional cultural specifics. To learn more about us and our products, please contact our managers.

Upd: 25 December 2024

Upd: 25 December 2024