The online gambling market in Africa remains a blind spot on the world map for many industry participants. This market is relatively young and underdeveloped. However, there are processes underway in this region that allow for fairly optimistic forecasts for gambling business in Africa.

We have prepared a review of the online gambling market in Africa and tried to draw conclusions about its future.

Current Landscape of Online Gambling in Africa

The online gambling landscape in Africa is undergoing a remarkable transformation, fueled by a surge in internet accessibility, mobile penetration, and changing perceptions toward gambling as a means of income.

According to Statista, the online gambling market in Africa is set to hit a revenue milestone of US$1.85 billion in 2024 with a projected CAGR of 6.28% from 2024 to 2028. This trajectory points to a market volume of US$2.36 billion by 2028, underlining the sector’s robust growth.

Specifically, the online sports betting market is expected to contribute significantly, reaching a volume of US$0.86 billion in 2024. This surge is indicative of the rising enthusiasm for sports-related gambling activities across the continent.

The average revenue per user (ARPU) in the online gambling market is forecasted to be US$309.30 in 2024. With an estimated 7.1 million users anticipated by 2028, there is a substantial user base poised for engagement and potential revenue generation.

Online gambling in South Africa is emerging as a hotspot for the industry, with increasing accessibility and convenience of internet services driving its popularity. Statista notes a notable uptick in the online gambling market within the country.

In comparison to other regions, Africa’s financial indicators are quite modest. The socio-economic landscape also plays a crucial role in shaping the online gambling market in Africa. In regions where up to 40% of the population lives below the poverty line and youth unemployment is high, gambling is often viewed as a potential source of income and a means of improving lives, as reported by The Guardian.

However, the projected annual growth of the African market is only slightly lower than in Europe, inspiring some optimism. Moreover, processes are already underway in Africa that could ensure the rapid development of the online gambling market in the near future.

Internet and Mobile Revolution as Catalyst for Growth

The exponential growth of mobile usage in Africa, particularly in Sub-Saharan Africa and North Africa, is a key driver for the online gambling business. The region witnessed a substantial rise in mobile users, with projections indicating a surge from 272 million in 2019 to an estimated 475 million by 2025. The high usage of 5G networks is expected to further propel the market forward, according to Research and Markets.

Africa’s growing share of global internet users is a testament to the continent’s digital evolution. The increase from 9.1% in 2017 to 13% in the past year underscores the expanding reach of the internet in Africa. With an internet penetration rate of about 40%, the continent’s digital landscape provides a fertile ground for the continued growth of the online gambling market.

Online Gambling Regulatory Environment in Africa

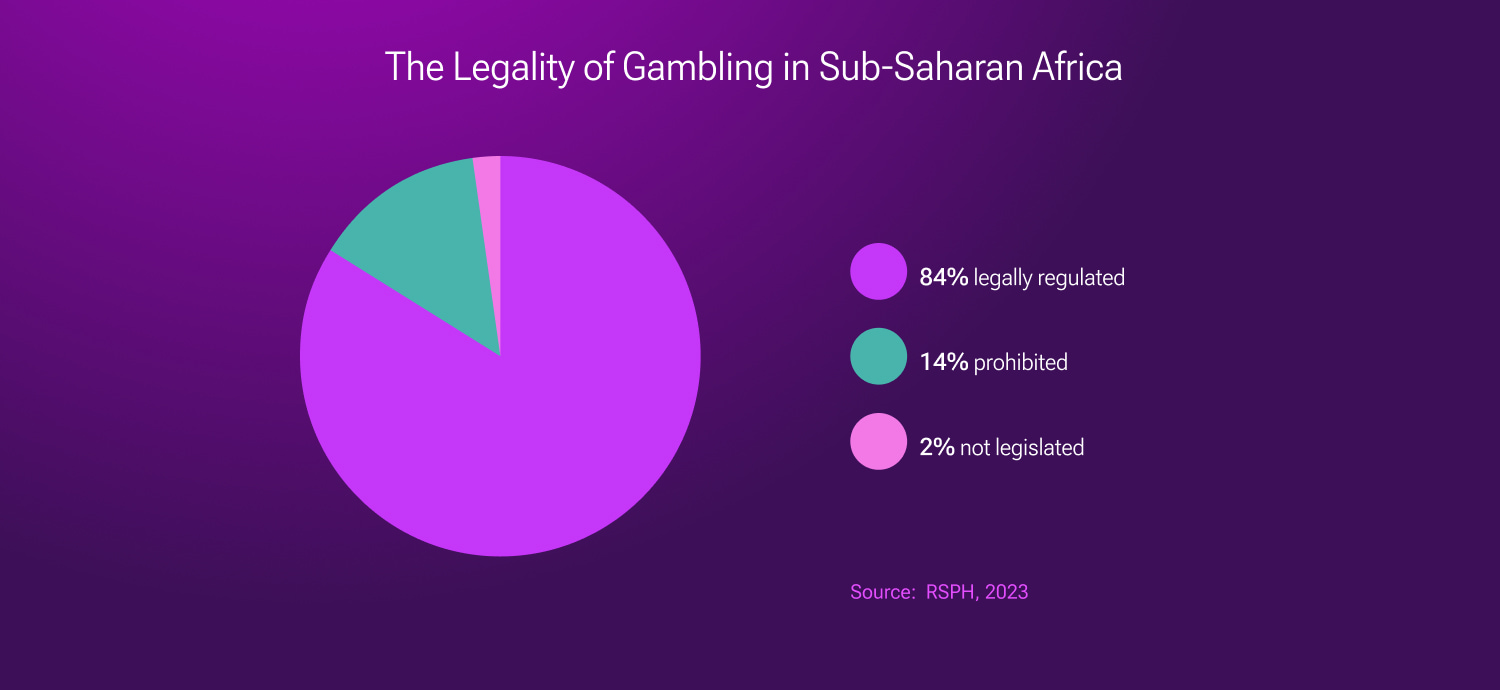

Is it legal to gamble in Africa? In a comprehensive study covering 41 African countries, it was found that 61% had established dedicated regulators for gambling activities. The remaining 39% saw regulation conducted either by government departments or through collaborations between semi-independent boards and government entities. However, public reporting of regulatory activities was noted to be sporadic, with only a handful of countries consistently publishing annual reports.

In some African countries, particularly those with a dominant Islamic presence, gambling faces legal restrictions due to religious prohibitions. Seven countries in the Sub-Saharan Africa region prohibit gambling, with Islamic beliefs influencing these decisions.

While some countries, like South Africa, have a well-established and regulated market generating significant revenue, others, such as Somalia and Egypt, maintain strict prohibitions on both online and in-person gambling. Countries like Botswana and Angola lack clear regulations, leading to international operators providing services in these regions.

A pervasive issue within the industry is fraud, exacerbated by the lack of stringent regulations. Some countries, such as Kenya, Tanzania, and Uganda, are actively taking steps to combat fraud and clean up the iGaming business, with expectations that more nations will follow suit.

Nigeria, a significant player in the African iGaming scene, is currently considered semi-regulated. While the legal framework allows for skill-based card games like Casino Hold’em and sports betting, challenges arise from sporadic enforcement and a lack of stringent regulations. The country’s revenue from gaming is largely dominated by sports betting facilities, with a few legal bricks-and-mortar casinos. There are currently also a handful of Nigerian-based and owned sports betting sites. These are extremely popular and 100% regulated.

Features of Launching iGaming Projects in Africa

Currently, there are companies, including ones from Europe, that tried launching iGaming projects in Africa. However, some of them quickly close down because they fail to consider the peculiarities of the market in this region. Let’s explore the features mentioned by representatives of the iGaming industry who have experience launching gambling ventures in Africa:

- Unconventional Research: The African market is quite different from what the iGaming business is accustomed to in Europe and Asia. Therefore, market research needs to be conducted using the most flexible methods, forgetting about templates that work in other markets.

- Orientation to Outdated Technology: Although the internet is becoming more widespread in the daily lives of Africans, it is still unstable in most regions. Additionally, users possess outdated devices by European and Asian standards, making resource-intensive applications and traffic-consuming games impossible to use in Africa.

- Simple Promo Campaigns: The local population is not accustomed to multi-level bonus systems, and few will want to navigate through them.

- Stable Work of Gaming Websites and Payment Systems: Due to outdated technology and an unstable economy, there is a high risk of disruptions in website and payment system operations. Among the local population, “word of mouth” plays a significant role. If the site is not working or the ability to withdraw money is lost — even for a short time period — an iGaming project almost instantly gains a reputation as a scam and experiences a significant player churn. Therefore, technical failures need to be anticipated, and as many backup payment providers as possible should be enlisted.

- Office in the Country of Operation: Managing an iGaming business in Africa remotely is almost impossible. A local office with technical specialists and a support team is essential. Support service must respond to user queries within an hour.

- Traditional Advertising: While digital advertising dominates almost everywhere else in the world, traditional forms of advertising still hold the greatest value in Africa — TV, radio, billboards, advertisements on the house walls, and even street promoters talking to people.

- Segmentation: The customer structure in Africa also has its peculiarities that should be considered in market research. The average age of players is around 20 years. They should be distinguished from the VIP segment, to which a higher quality of service should be offered.

- Long-Term Potential: It should be recognised upfront that the return on investment will occur with a significant delay compared to wealthier markets.

- Affiliate Specifics: Each African country has its local affiliates, and there are no international affiliates. Also, please note that the rules governing African affiliates may differ significantly from those you are accustomed to on other markets.

Make correct conclusions from your research, set realistic goals – remember that Africa is not a developed market. Have a connection with the market – a presence on the ground. Prioritise both acquisition and retention, paying attention to both to earn trust. Trust plays a key role in Africa: pay as fast as possible, answer complaints as fast as possible.

The Future of Online Gambling in Africa

Africa’s younger generation, growing up in an era of unprecedented technological exposure, is a driving force behind the future of online gambling. As online infrastructure continues to improve, end-user technology is developing to make online gambling more accessible than ever.

As countries witness the positive impacts of regulated gambling, especially online, it becomes challenging for others to ignore the opportunities and benefits. Drawing lessons from the developed US gambling industry, Africa sees the value of clear and comprehensive legislation. The US model, with advanced regulations, strong consumer protections, and technological infrastructure, serves as a beacon for Africa’s balancing act between economic growth, consumer protection, and social responsibility.

The future of online gambling in South Africa appears promising, with proposed legislation aiming to create a more regulated and safer environment for players and operators. The South African government’s ability to raise significant tax revenue from the industry underscores its economic impact.

As Africa navigates the uncharted waters of the online gambling realm, the continent is poised for transformative growth. The convergence of a tech-savvy population, evolving regulatory frameworks, and the integration of cutting-edge technologies paints a promising picture for the future. With South Africa leading the way, the African online gambling market is on the cusp of a significant evolution, offering both challenges and opportunities for stakeholders in this dynamic industry. As the dice roll, Africa’s online gambling story is just beginning, and the journey ahead promises to be both thrilling and transformative.

In conclusion, it is important to note that EvenBet Gaming is a supplier of 38+ card games for the iGaming industry. We develop not only globally recognised poker games but also adapt games for various regions and develop games popular in specific countries. We also have extensive experience in game localisation. If you would like to discuss your project in the iGaming sphere (poker business in Africa in particular), please contact our managers.

Upd: 26 August 2024

Upd: 26 August 2024