The Asian online iGaming market surpassed $19 billion in revenue in 2024, with projections suggesting it could reach around $39 billion by 2030. This rapid growth has drawn significant attention from global investors eager to tap into the region’s vast potential.

Yet, Asia is far from a one-size-fits-all market. It’s a complex and highly fragmented landscape shaped by diverse cultures, legal frameworks, consumer behaviors, and technological readiness.

In this article, we explore the key characteristics of Asia’s iGaming ecosystem. Whether you’re considering expansion or a market entry, this overview will help you understand what it takes to succeed—and what challenges to anticipate—when launching an online gambling venture in this part of the world.

Asian iGaming Market Context

Asia’s iGaming market is far from homogeneous. This makes deep localization a must. For example, Chinese Poker is known as Pusoy in the Philippines — a nuance that absolutely needs to be considered. And it goes well beyond just language. Key variables such as median age, income levels, internet speed, and smartphone penetration vary dramatically from country to country—shaping user behavior and product expectations in the process.

For instance, Thailand’s median age is 40.6 years, while the Philippines’ is just 26.1. It’s no surprise that player preferences and content performance differ significantly between the two.

Technical infrastructure also plays a major role. In many island nations, building and maintaining stable, high-speed internet connections is a challenge. As a result, high-end mobile apps with complex graphics often struggle to gain traction in markets like the Philippines. To succeed, iGaming products must be lightweight, data-efficient, and optimized for lower-end Android devices.

| Population | GDP Per Capita | Median Age | Average Mobile Internet Download Speed | Smartphone Market | |

| Korea | 57.1M | $34,974 | 45.6 | 148.34 MB/s | Samsung majority, very few low end |

| Japan | 124.5M | $33,138 | 49.4 | 51.95 MB/s | Mostly Apple, mid-range evenly used |

| Philippines | 117.3M | $4,130 | 26.1 | 35.24 MB/s | Chinese Android brands — mostly low end |

| Thailand | 71.8M | $7,527 | 40.6 | 61.21 MB/s | Apple/Samsung half the market, mid + low range Android |

| Malaysia | 34.3M | $12,253 | 31 | 104.99 MB/s | Apple/Samsung half the market, mid + low range Android |

| Indonesia | 244.5M | $4,469 | 30.4 | 40.37 MB/s | Low end Android, cohort of Apple users |

| Vietnam | 98.9M | $4,469 | 33.4 | 75.72 MB/s | Apple/Samsung split, mid range Android |

| India | 1.4B | $2,878 | 28.8 | 100.78 MB/s | Android dominant, no Apple |

Source: Testa, 2025

Across the region, the shift from mobile-first to mobile-only is already well underway. In markets such as the Philippines, desktop gaming is rapidly disappearing. Players overwhelmingly use smartphones—not just as a preference, but as the default access point for online entertainment. Supporting desktop applications is increasingly unnecessary.

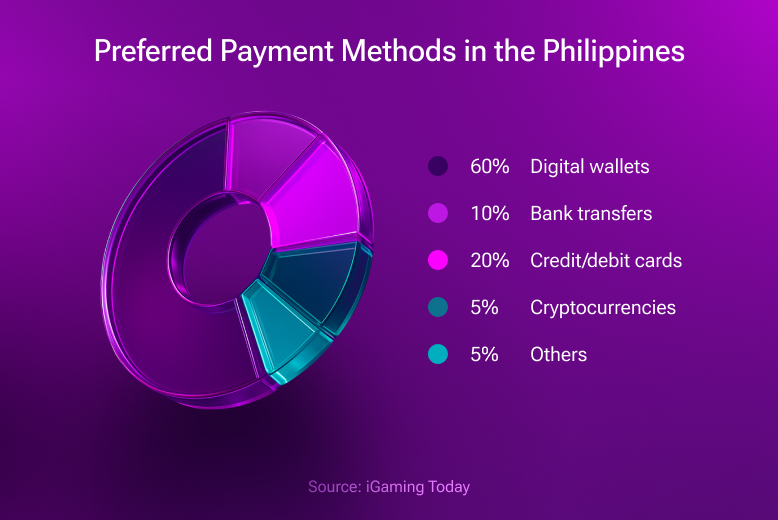

Another critical factor is payment behavior. In the Philippines, for example, players are accustomed to near-instant deposits and withdrawals. A wait time of even 30 minutes can damage trust. In fact, the speed of financial transactions is one of the top credibility markers for iGaming operators in the region.

Operators entering Asian markets must design around these local realities—from the user journey and device constraints to infrastructure limitations and payment preferences.

Key iGaming Trends in Asia

1. Evolving Gambling Legislation

Asia’s iGaming industry is undeniably expanding, but regulatory progress varies dramatically across the region. Some of the most populous and economically advanced countries still prohibit online gambling—often due to religious, ideological, or social concerns.

That said, a growing number of governments, including those in Thailand, Sri Lanka, and to some extent Malaysia, are beginning to acknowledge the scale of unregulated online gambling and the significant tax revenues they’re losing as a result. These governments are closely observing the Philippines, where a well-regulated iGaming sector contributes meaningfully to public budgets—supporting infrastructure, social services, and broader economic growth.

While the Philippines offers a compelling blueprint for sustainable regulation, the idea that other countries will follow suit remains speculative. Legalization and regulation may eventually spread, but meaningful change is unlikely in the near term.

2. Integrated Resort Development

The development of integrated resorts (IRs) with casino components is a global trend—and Asia is no exception. Major IRs already operate in countries like the Philippines and Singapore, and new projects have been approved or are under construction in Thailand, the UAE, and Japan.

While IR development does not automatically signal regulatory openness to online gambling, it is a promising development for iGaming software providers. Land-based casinos are increasingly exploring digital tools to enhance their offerings and extend player engagement beyond the gaming floor.

3. The Convergence of Land-Based and Online Gaming

Asia is home to a large number of land-based casinos, especially in the Philippines. These operators are increasingly concerned about losing market share to the online sector—and many are now actively exploring how to integrate digital components into their business models, or even launch their own online platforms.

However, the transition isn’t always straightforward. In markets like the Philippines, there’s a notable shortage of tech talent and limited infrastructure for in-house software development. As a result, many land-based casinos are turning to third-party providers for ready-made iGaming solutions.

At EvenBet Gaming, we’ve already received such inquiries and are open to exploring partnerships that help land-based operators expand into the digital space efficiently and responsibly.

Conclusion

Gambling has long been a part of life in many Asian countries. So when operators introduce online gaming, they’re not offering something entirely new—they’re simply evolving an established behavior. That said, digital gaming comes with its own unique dynamics, and success depends on how well those differences are communicated and delivered to the local audience.

Competition in Asia’s iGaming space is fierce. Understanding how your product is perceived in each market is critical. Is your game suited to a younger audience or a more mature demographic? How does it perform on the most commonly used smartphones in that country? Is it lightweight enough for limited data environments? Are the payment options trusted and familiar? And most importantly—how fast can players deposit and withdraw funds?

At EvenBet Gaming, we have extensive experience supporting operators across the Asian region as a trusted software provider. Our platform is built with localization in mind, offering flexible tools to tailor both content and user experience for specific markets. We also offer a wide selection of region-specific games such as Teen Patti, Rummy, Call Break, Big 2, and more.

Get in touch with our team to discuss how we can support your next iGaming project in Asia.

Upd: 24 September 2025

Upd: 24 September 2025  Windows

Windows  macOS

macOS  iOS

iOS  Android

Android