Why would any online casino even bother with poker if it brings in such a small share of the industry’s revenue? It’s a fair question: how do casinos make money on poker when the numbers look so modest?

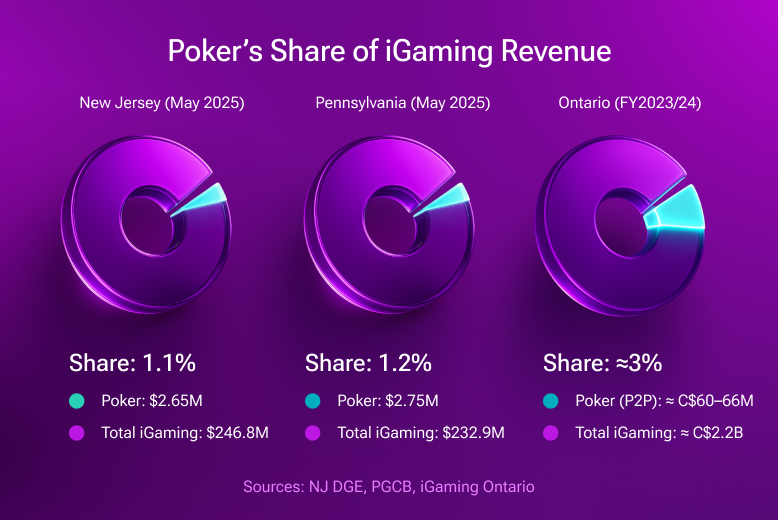

In most regulated markets, online poker rarely exceeds 1–3% of total iGaming gross gaming revenue (GGR). In New Jersey, for instance, poker generated just $2.65 million in May 2025, compared to nearly $247 million from the state’s broader iGaming market. Other markets — like Pennsylvania or Ontario — show the same pattern.

Still, dismissing poker because of its low direct revenue would be a mistake. The real answer to how a casino makes money from poker lies in poker’s role as a player acquisition tool and a cross-sell engine. Poker brings in new users at a relatively low cost, nurtures them through community and competition, and then introduces them to higher-margin products such as online slots, live dealer games, or even sportsbooks.

This is why poker continues to be a strategic product for online casinos. Flutter, for example, reported that more than 30% of PokerStars customers eventually became multi-product players, boosting the overall online casino profit margin.

The U.S. market provides a useful illustration, but the logic applies globally — from European regulators to emerging crypto casino poker platforms. And in the U.S., the dynamics are shifting further thanks to the Multi-State Internet Gaming Agreement (MSIGA). As of September 2025, Nevada, Delaware, New Jersey, Michigan, West Virginia, and Pennsylvania are pooling player liquidity across state lines. Larger networks mean better games, more engagement, and more chances for casinos to monetize poker far beyond the rake.

The Basics: Direct Revenue Streams in Online Poker

Before diving into the bigger picture of how casinos make money from poker, it’s worth acknowledging the most straightforward revenue channels. These mechanisms are familiar to most operators but set the stage for understanding poker’s broader value.

- Rake. A small percentage taken from each cash game pot, usually capped at a fixed maximum. This is the primary way both online and land-based casinos monetize cash tables.

- Tournament fees. Added to buy-ins as a service charge. For example, a $100 + $10 entry means $100 goes into the prize pool, while $10 is the casino’s guaranteed revenue.

- Premium access. Online poker platforms may charge for access to VIP tables, special formats, or exclusive events. This is especially relevant for hybrid models, including crypto casino poker, where premium tournaments and faster withdrawals add to the appeal.

These revenue streams are only part of the answer to how an online casino makes money on poker. On their own, they generate modest margins compared to slots or table games. The real profit comes from what happens around poker — acquisition, engagement, and cross-sell — which we’ll explore next.

Monetization Mechanics Online Casinos Actually Use

Poker as an Acquisition Funnel

For online casinos, poker is less about direct revenue and more about strategic growth. It consistently attracts strategy-minded, community-driven players who are often harder to reach through traditional casino advertising. As a result, customer acquisition costs are typically lower compared to casino-only funnels — a powerful answer to the question how does a casino make money from poker.

Scale is also critical. When operators pool liquidity across jurisdictions, the product becomes instantly more attractive: bigger prize pools, faster game starts, and stronger retention. In 2025, WSOP Online merged player bases across four U.S. states, while BetMGM expanded its shared network from Michigan and New Jersey to include Pennsylvania. These moves underline why liquidity is not just a product feature but a monetization driver — larger networks create more chances to cross-sell players into higher-margin verticals like slots and live dealer games.

Cross-Sell Journeys

The real profit lies in the player journey. Leading operators have built sophisticated systems that guide poker players seamlessly into other products:

- Unified wallet and loyalty. BetMGM Rewards credits can be earned across poker, casino, and sportsbook, while Caesars Rewards integrates WSOP Online play into its wider loyalty ecosystem. This keeps players engaged across multiple verticals and maximizes the online casino profit margin.

- In-client casino modules. PokerStars even includes a “Show Casino Games” toggle directly in the poker client, giving players one-click access to casino titles during downtime.

- Promotional ladders. The PokerStars Power Path mechanic turns engagement into progression, with rewards that can be tailored to introduce casino offers.

- Leaderboards and events. BetMGM and Borgata’s SPINS Leaderboard campaigns illustrate how competitive incentives in poker can trigger cross-product activity.

Brand Halo & Content Economics

Poker also delivers outsized marketing value. Tent-pole events such as WSOP Online and Borgata Opens generate mainstream media coverage and social buzz at a fraction of the cost of traditional advertising. This earned media halo not only reinforces brand reputation but also drives measurable increases in casino play during and after festival periods.

At the same time, online qualifiers that feed into live events generate incremental revenue far beyond poker. Packages typically include room nights, food and beverage, and additional on-property spend, turning each poker event into a holistic revenue engine for the casino.

Poker’s Operational Challenges — and How Casinos Can Address Them

Online poker has long been recognized for the strategic value it brings: user acquisition, cross-sell potential, community building, and brand loyalty.

However, despite this upside, many casino-focused operators avoid integrating poker. The reasons are well-known and structural:

- Different monetization model: traditional poker depends on rake, tournament fees, or premium access — revenue streams that are modest and unpredictable compared to high-margin casino verticals.

- Operational complexity: maintaining a real poker room requires a dedicated team — product managers, support and risk operations, community moderators, and constant lobby management.

- Liquidity and ecosystem demands: to keep games attractive, rooms must maintain healthy liquidity across stakes and formats — a non-trivial task, especially for smaller or newer operators.

- Mismatch with casino UX and player behavior: casino players are used to quick sessions, instant outcomes, and minimal friction. Traditional poker’s longer sessions, learning curve, and lobby wait times often clash with that behavior.

- High maintenance overhead and ecosystem risks: managing rake, anti-collusion, bots, seat-balancing, and tournaments demands resources. Many operators simply don’t want to commit to that — even if they see poker’s long-term value.

Taken together, this creates a strategic paradox: poker offers deep value, but the cost and complexity of running a full poker room frequently outweigh the benefits — even for large operators.

What Poker Solutions Work Best for Casino Operators

In response to these challenges, casino-oriented poker solutions have evolved in a different direction. Instead of replicating classic poker-room logic, they focus on a few core principles:

-

Casino-first UX. Poker should feel like a native casino game, not a separate ecosystem.

-

Fast sessions and instant entry. Minimal steps from click to gameplay, with no long onboarding or learning curve.

-

Reduced operational overhead. No need for large poker-specific teams or constant ecosystem management.

-

Preserved player value. Retaining poker’s key strengths — competition, skill, and social interaction — without the traditional complexity.

This approach allows casinos to benefit from poker’s strategic upside while avoiding its historical barriers. Two examples of such solutions are One Click Poker and Spins Poker, each addressing the problem from a different angle.

One Click Poker: Casino-Native Player-to-Player Poker

One Click Poker is poker built exclusively for casino operators, designed from the ground up for casino environments rather than adapted from traditional poker platforms.

Instead of a standalone poker lobby with table lists and filters, One Click Poker is presented as a single game icon inside the casino lobby. One click launches real player-versus-player action.

The player flow is deliberately simple:

-

Click the game

-

Confirm the buy-in

-

Start playing instantly

There is no separate poker room, no learning curve, and no need for prior poker experience. The experience mirrors the way players launch slots or table games, while still delivering genuine human competition.

From an operator perspective, One Click Poker:

-

Eliminates the need for tournaments and complex configurations

-

Requires no dedicated poker management team

-

Integrates seamlessly into existing promotions, missions, and bonuses

-

Offers guaranteed liquidity through operator traffic or an integrated network

One Click Poker is built for casinos that want to add poker for the first time, diversify their game portfolio, and introduce social PvP gameplay without launching a full poker ecosystem.

Spins Poker: Fast-Paced Poker for Instant Engagement

While One Click Poker focuses on casino-native access to classic poker formats, Spins Poker addresses a different challenge: adapting poker to fast, session-based casino play.

Spins Poker delivers short, hyper-turbo rounds designed for players accustomed to instant outcomes. The focus is not on long sessions or deep strategy trees, but on quick decision-making, excitement, and repeat play.

Key characteristics of Spins Poker include:

-

Short, fast-paced sessions aligned with casino player behavior

-

Skill-based competition without long-term commitment

-

No dependency on traditional poker-room infrastructure

-

Low ecosystem risk, with gameplay managed like any other fast casino game

For operators, Spins Poker combines poker’s competitive appeal with the operational simplicity of modern casino formats. It supports retention and cross-product migration while remaining lightweight and scalable. This approach has already gained industry recognition: Spins Poker by EvenBet Gaming was shortlisted for the European iGaming Awards in the 2025 Innovation of the Year category.

How Land-Based Casinos Monetize Online Poker

Licensing and Revenue Share

In the United States, regulatory frameworks require online poker rooms to operate under the umbrella of a licensed land-based casino. In states such as New Jersey and Pennsylvania, this usually takes the form of skin agreements and revenue-sharing models. The structure ensures that both the digital brand and the physical casino benefit.

Examples are easy to find: Resorts Atlantic City partners with PokerStars for its New Jersey operations, while Borgata teams up with BetMGM Poker to extend its brand online. For land-based casinos, this means recurring digital revenue streams without the need to build a platform from scratch.

Loyalty Integration

The link between online play and real-world rewards is another strong monetization driver. Caesars Rewards integrates WSOP Online activity directly into its tier credits, creating a seamless loop between digital poker sessions and benefits at Caesars properties. Similarly, BetMGM Poker players earn MGM Rewards points, which can be redeemed for hotel stays, dining, or entertainment. These programs transform online poker from a standalone product into part of a larger omnichannel ecosystem.

Satellites and Hybrid Events

Online satellites that qualify players for live tournaments have long been a proven strategy, and they remain a cornerstone of casino monetization today. A player who wins an online seat at a Borgata festival or a WSOP bracelet event does more than just enter the tournament. They also book hotel rooms, dine on property, and often spend additional money at the tables or in the sportsbook.

This hybrid model shows the broader answer to how casinos make money from poker: not just from rake or fees, but by leveraging poker to drive incremental revenue across the entire property.

Conclusion

Poker may account for only a modest share of online gaming revenue, but its strategic impact is far greater than its direct profit margins. For operators asking how does a casino make money from poker, the answer is clear:

- Efficient acquisition. Poker brings in engaged players at a lower cost than casino-only funnels.

- Cross-sell potential. It acts as a proven bridge into higher-margin verticals such as slots, table games, and sports betting.

- Brand halo and loyalty. Tent-pole events, strong communities, and loyalty integrations make poker a long-term retention driver.

- Hybrid value for land-based casinos. Online satellites and loyalty programs translate digital play into hotel stays, dining, and on-property spend.

With the right platform, poker becomes not just a niche product but a profitable ecosystem enhancer for online casinos — one that improves acquisition efficiency, supports retention, and expands overall online casino profit margins.

EvenBet Gaming delivers scalable online poker solutions designed to maximize cross-sell, retention, and omnichannel monetization.

Upd: 3 February 2026

Upd: 3 February 2026