Africa is one of the most promising — and underserved — regions for online poker. While sportsbook and lottery dominate the iGaming landscape, poker is quietly gaining traction.

In this article, you’ll learn how big the African gaming market really is, where online poker fits in, and which formats work best for local players. We’ll explore the most effective ways to launch poker in Africa, from lightweight casino integrations to mobile-first PvP formats like Spins and Fast-Fold. At EvenBet Gaming, we’ve already launched several successful projects in the region — including with Hollywoodbets and Devilfish — and our firsthand experience confirms that Africa is a high-potential market.

Whether you’re planning to add poker to a sportsbook or test a new market, this guide gives you the insights to do it right.

How Big Is the African Gaming Market — and Where Does Online Poker Fit In?

Africa is rapidly becoming one of the most promising frontiers for digital gambling. With mobile-first behavior, rising smartphone adoption, and steady growth in online payment infrastructure, the continent’s iGaming sector is entering a new phase. For 2025, regulated gambling in Africa was projected to generate over €5.5 billion in gross gambling revenue (GGR) — and online channels are taking a bigger slice every year.

South Africa remains the largest market, accounting for more than €3 billion in GGR, with nearly 50% of that coming from online. Sports betting leads the charge, contributing over €1.8 billion alone. In markets like Nigeria, Kenya, and Ghana, mobile betting continues to expand rapidly, driven by wallet-friendly formats and high mobile penetration. In fact, 81% of online gambling spend in South Africa now happens via mobile devices.

So, how big is the African gaming market? The answer depends on where you look — but one thing is clear: operators who design for mobile-first, fast-play experiences are best positioned to capture long-term growth.

Where Does Poker Fit In?

Despite the region’s momentum, online poker remains a small piece of the puzzle. In most markets, poker contributes less than 3–5% of online GGR. It’s often bundled under broader gaming categories and receives little attention in mainstream reporting. But that doesn’t mean it has no value.

On the contrary: poker’s strength lies in its strategic function — as a retention layer, a cross-sell tool, and a community builder. When used wisely, it complements high-volume verticals like sportsbook and casino, without trying to compete directly on volume.

Why Poker Still Matters

Even in markets where poker isn’t driving revenue, operators see strong upside in terms of engagement:

- Freeroll poker tournaments help onboard new players with no financial friction.

- Rakeback and referral programs are effective in boosting stickiness — especially where average revenue per user (ARPU) is low but play frequency is high.

- Fast poker formats (e.g., spins, fast-fold) align well with Africa’s mobile-first behavior and short-session preferences.

In this context, poker doesn’t need to be the star of the show — it just needs to play its part. As part of a broader platform strategy, online poker in Africa can drive player lifetime value, increase average session time, and enhance loyalty mechanics.

The Legal Status of Online Poker in Africa

Across most of Africa, online poker lives in a gray area. It’s not outright banned in many countries — but it’s also not clearly regulated as a standalone vertical. In many jurisdictions, poker is simply left out of legislation, or loosely categorized under broader “interactive games,” which makes it tricky — or even impossible — to launch a fully licensed poker room.

That said, the trend is slowly shifting. Regulators are still mainly focused on sports betting, but several countries are starting to explore broader frameworks for online gambling. The progress is cautious, but real.

For now, the most practical approach is to treat poker as a supporting feature rather than a core product. Many operators integrate poker into their sportsbooks or online casinos as a light-touch add-on — quick to play, mobile-friendly, and easy to understand. Building a dedicated poker room only makes sense in select markets where licensing and demand align. Everywhere else, flexible formats like One Click Poker, Spins, or Fast-Fold are safer bets.

So, what does the legal map look like across the continent? Let’s take a closer look by country.

Angola

Angola is the most legally mature market for online poker in Africa. For operators seeking full compliance and long-term growth, it presents a rare combination of legal certainty and first-mover opportunity. It’s the only jurisdiction on the continent where launching a dedicated online poker room is fully possible and even officially encouraged.

Legal Status of Poker in Angola

As of late 2024, Angola fully legalized online poker under its new Gaming Law (Law 17/24), replacing the outdated 2016 framework. The law explicitly permits online gambling, including sports betting, casino games, lotteries, bingo, and poker, as long as the operator obtains a license through a formal public tender. Angola is currently the only country in Africa where online poker is legally defined, licensable, and supported by regulation.

How Poker Business Operates in Practice in Angola

Although the legal framework is new, implementation is underway. Several local companies, such as ACK Games and Bantu Bet, have already entered the market, and international brands like 888Africa are preparing to follow. Poker is still in the early stages — available on a limited number of platforms as part of broader casino offerings — but the legal environment allows for both integrated poker features and standalone poker rooms.

Risks

- Licensing is mandatory, with strict conditions: local entity setup, onshore server hosting, and real-time integration with the ISJ monitoring system.

- No tolerance for unlicensed operations — Angola’s gambling regulator, the Instituto de Supervisão de Jogos (ISJ), is expected to enforce compliance closely.

- While regulatory clarity is high, commercial demand for poker remains untested, and operators are advised to launch gradually and invest in player education.

Ghana

Ghana is a stable and transparent jurisdiction for online gambling, with legal space to offer poker under broader casino licensing. While the domestic poker scene is still underdeveloped, the environment is low-risk for testing lightweight poker formats or targeting players through offshore models. As the regulatory framework evolves, Ghana may become a viable candidate for more structured poker growth.

Legal Status of Poker in Ghana

Online gambling is permitted in Ghana under the Gaming Act, 2006 (Act 721) and regulated by the Gaming Commission of Ghana. The law explicitly allows sports betting, casino games, and other interactive products. While poker is not specifically mentioned, it may be offered legally as part of an “interactive games” license. There is no dedicated poker licensing category, but also no prohibition, placing poker in a legally neutral space.

How Poker Business Operates in Practice in Ghana

Ghana has a well-developed iGaming landscape, especially in major urban centers like Accra, with dozens of licensed sportsbook and casino operators.

However, no domestic operator currently runs a dedicated online poker room. Instead, poker appears in limited forms — typically video poker or live dealer tables offered under casino licenses.

Local players freely access international poker sites, and offshore platforms are not blocked. Popular mobile money services like MTN MoMo and AirtelTigo make deposits simple, although most poker operators don’t support them natively.

Risks of Running an Online Poker Business in Ghana

- Poker is not restricted, but it’s also a low-priority vertical for regulators. Any local launch should be coordinated with the Gaming Commission to ensure compliance under existing licensing terms.

- Offshore operators currently face little to no enforcement, but Ghana may move toward tighter control or localized licensing as the sector matures.

- A 10% tax on gambling winnings that previously applied to poker was abolished in 2025, reducing the tax burden for players and improving appeal — but future policy changes remain possible.

Kenya

Kenya presents a technically open but legally undefined market for online poker. While player interest exists and access to international sites is widespread, the absence of a clear regulatory pathway means operators should be cautious. The best strategy involves low-friction, embedded poker experiences within broader casino or betting ecosystems — and avoiding aggressive local promotion to stay under the radar.

Legal Status of Poker in Kenya

Kenya’s gambling industry is governed by the Betting, Lotteries and Gaming Act, with oversight by the Betting Control and Licensing Board (BCLB). While the law permits online gambling under general “gaming” licenses, it does not explicitly mention poker as a regulated product. As of 2025, no Kenyan operator holds a dedicated poker license, and there is no specific legal framework addressing online poker as a vertical.

How Poker Business Operates in Practice in Kenya

There are no licensed online poker platforms operating out of Kenya. However, some local sportsbooks and casinos offer poker-like games, such as video poker or live dealer tables, within their casino sections.

Players who seek real poker experiences typically use offshore platforms, either directly or through VPN access.

Deposits are often made using M-Pesa, Kenya’s widely adopted mobile money solution, which can be used with select non-local operators. Notably, there is no history of enforcement against individual players or offshore poker sites.

Risks of Running an Online Poker Business in Kenya

- Kenya’s regulatory efforts are concentrated on sports betting, which is subject to a 5% excise tax on stakes as of 2025.

- Poker remains in a regulatory gray zone — not banned, but also not clearly permitted or supported by licensing infrastructure.

- Offshore operators function without formal recognition, and could face restrictions if Kenya updates its gaming laws in future reform cycles.

- Advertising poker locally may raise flags, especially when linked to broader casino promotions or if perceived as targeting vulnerable users.

Nigeria

Nigeria offers a high-potential but legally fragmented environment for online poker. With a mobile-first audience and growing digital adoption, the opportunity is clear — but regulatory ambiguity and evolving tax obligations require caution. For now, offshore operators can access the market discreetly, but must stay agile and aligned with state-level legal developments.

Legal Status of Poker in Nigeria

Online poker is not explicitly regulated at the federal level in Nigeria. Until late 2024, the sector was governed by the National Lottery Act (2005) and overseen by the National Lottery Regulatory Commission (NLRC). However, a Supreme Court ruling in 2024 decentralized gambling regulation, giving individual states full authority over licensing and enforcement.

There is no national licensing category for online poker, but in more progressive states like Lagos, poker may be permitted under broader gaming or lottery licenses. This creates a fragmented legal landscape.

How Poker Business Operates in Practice in Nigeria

Some local sportsbook and casino operators include poker-style games, but there are no licensed domestic online poker rooms offering full poker ecosystems.

Instead, players commonly access offshore platforms, where poker is offered as part of a broader iGaming product. Access is generally unblocked, and payments can be made through cards or local fintech apps.

State regulators such as the Lagos State Lotteries and Gaming Authority (LSLGA) may allow certain interactive games, but implementation and enforcement vary by region.

Risks of Running an Online Poker Business in Nigeria

- The legal framework is in flux: state-level laws differ, and operators must track changes jurisdiction by jurisdiction.

- A nationwide tax regime now applies: 5% on gambling winnings for residents, 15% for non-residents, and a 5% excise tax on betting stakes. Offshore operators may face compliance risks if targeting Nigerian users.

- Enforcement against offshore poker sites is currently minimal, but this could shift as state regulators mature and coordination increases.

- Players using offshore platforms have no legal protection or access to local dispute resolution, raising long-term trust issues.

Rwanda

Rwanda offers a low-risk but low-visibility environment for online poker. While offshore access is possible and enforcement is minimal, the lack of explicit legal support makes Rwanda an uncertain market for dedicated poker expansion. Operators considering entry should prioritize flexible, embedded formats — rather than full-scale standalone rooms — and closely monitor any regulatory developments.

Legal Status of Poker in Rwanda

Rwanda allows online gambling under a structured regulatory framework led by the Rwanda Gaming Corporation (RGC). However, online poker is not explicitly mentioned in current legislation or licensing categories. The law permits sports betting, lotteries, and casino-style games under formal operator licenses, but poker falls into a gray area — it is not banned, but requires specific authorization on a case-by-case basis.

How Poker Business Operates in Practice in Rwanda

As of 2025, no domestic platforms offer licensed online poker in Rwanda, either as standalone products or as part of broader casino portfolios. The local market is dominated by sports betting operators, with limited penetration of table games online.

That said, players are able to access international poker platforms, and there are no known restrictions or enforcement actions against users or offshore operators. Payment methods like MTN MoMo and Airtel Money dominate the landscape, but are generally not connected to offshore poker sites.

Risks of Running an Online Poker Business in Rwanda

Poker is not directly prohibited, but offering it without specific approval could place an operator outside the licensed framework, especially if integrated into a local gambling platform.

There is no standardized licensing path for poker products, which creates uncertainty for compliance.

Rwanda has demonstrated increasing interest in digital regulation, and new rules could emerge quickly, potentially tightening oversight of unclassified products like poker.

South Africa

South Africa is one of Africa’s most advanced and lucrative digital gambling markets — but online poker remains legally off-limits. Still, offshore access is widespread, and the market is active beneath the surface. For now, discreet market entry without local promotion is possible, but operators must proceed with strict compliance and minimal visibility to avoid triggering legal scrutiny.

Legal Status of Poker in South Africa

Online poker is explicitly illegal under the National Gambling Act (2004), which permits only online sports betting via licenses issued by provincial authorities. Poker and online casino games fall under the category of “interactive gambling”, which is strictly prohibited.

A proposed Remote Gambling Bill has been under discussion since the mid-2000s, aiming to legalize and regulate online casino-style games — including poker — but as of 2025, it has not been enacted.

How Poker Business Operates in Practice in South Africa

Despite the prohibition, South African players regularly access international poker platforms. These sites are not blocked, and players can register and deposit using e-wallets, prepaid cards, or cryptocurrency.

There are no local poker licenses, but offshore brands continue to target South Africa quietly, drawn by its high internet penetration, strong mobile gambling culture, and well-established betting infrastructure.

Risks of Running an Online Poker Business in South Africa

- As of 2025, players are not prosecuted, and offshore poker platforms operate without interference — as long as they avoid local marketing and direct financial integration with South African banks.

- A 2025 Supreme Court ruling reaffirmed that all interactive casino-style games are illegal, even when repackaged as fixed-odds or sweepstakes formats.

- Winnings from illegal gambling are legally subject to confiscation, and regulators have issued formal warnings against unlicensed operators.

- Operators engaging in visible advertising, influencer partnerships, or local infrastructure risk enforcement actions, including domain blocking and reputational fallout.

Tanzania

Tanzania is a tightly regulated, sportsbook-first iGaming market, where poker is effectively excluded from legal offerings. Offshore operators can quietly reach Tanzanian players, but should avoid public visibility or use of local financial infrastructure. Unless poker is formally added to the list of permitted games, licensing a poker room locally is not currently possible.

Legal Status of Poker in Tanzania

Tanzania operates under a well-defined gambling framework established by the Gaming Act (2003) and enforced by the Gaming Board of Tanzania (GBT). In 2019, the law was amended to cover online gambling, introducing strict requirements like local server hosting and real-time integration with the regulator’s monitoring system.

However, online poker is not explicitly listed among the approved gambling products. While sports betting and online casino games are legal and licensed, poker remains unregulated and cannot be licensed locally under current law.

How Poker Business Operates in Practice in Tanzania

There are no licensed Tanzanian poker platforms, and poker is not offered even as a feature within legal online casinos. Most local operators focus on sports betting and select casino games, such as slots and live roulette.

That said, Tanzanian players can access offshore poker sites without restriction, and there are no known enforcement actions against players or foreign platforms.

Payments are predominantly mobile-first, using services like Vodacom M-Pesa, Airtel Money, and Tigo Pesa. While these are widely used for betting, their availability for offshore poker depends on individual platform support.

Risks of Running an Online Poker Business in Tanzania

- Poker is not included in the country’s list of licensed online gambling activities, meaning any attempt to offer it locally would likely be non-compliant.

- The GBT takes enforcement seriously — requiring full technical compliance from licensed operators. Attempts to offer poker via local channels without explicit approval could trigger intervention.

- While offshore operators currently face no direct enforcement, those who become visible — through localized marketing, payment integration, or affiliate activity — may attract regulatory scrutiny in the future.

Uganda

Uganda presents a low-risk but low-return environment for online poker. The legal framework allows for iGaming, but poker remains a niche product with limited traction. For operators looking to test lightweight poker offerings in emerging markets, Uganda offers a quiet entry point, but not a strategic priority without broader player education or demand-building efforts.

Legal Status of Poker in Uganda

Online gambling in Uganda is legal and regulated under the Lotteries and Gaming Act (2016), with oversight by the Lotteries and Gaming Regulatory Board (LGRB). The legislation allows for sports betting, lotteries, and online casino-style games, but does not explicitly mention poker. There is no dedicated licensing framework for online poker, though theoretically, it could be offered under a general gaming license — subject to regulatory discretion.

How Poker Business Operates in Practice in Uganda

There are no licensed online poker platforms operating in Uganda. Most local gambling businesses focus on sports betting and virtual casino games, which have broader market appeal and regulatory familiarity.

Poker is rarely included even as a feature in licensed casino products.

However, Ugandan players can access offshore poker sites without restriction, and there are no reported cases of enforcement against users or foreign operators. Mobile money services like MTN MoMo and Airtel Money dominate the payments space and are sometimes used to fund accounts on international platforms.

Risks of Running an Online Poker Business in Uganda

- While the market is legally open, poker remains commercially underdeveloped: low public awareness, limited demand, and no local poker ecosystem.

- Offshore poker operators face minimal enforcement risk, as poker is not currently a regulatory focus.

- However, licensed operators must still comply with Uganda’s anti-money laundering (AML) and responsible gambling requirements, which apply to all online gaming activity — regardless of vertical.

Overview Table: Online Poker Regulation by Country in Africa

| Country | Online Poker Status | Regulators | Notes |

| Angola | Legal (licensed) | Instituto de Supervisão de Jogos (ISJ) | New 2024 law legalizes online poker under license; implementation underway. |

| Ethiopia | Prohibited | National Lottery Administration (NLA) | No legal framework for poker; some betting activity allowed under lottery oversight. |

| Ghana | Unregulated | Gaming Commission of Ghana | Poker not explicitly regulated; may be allowed under “interactive games” licenses. |

| Kenya | Unregulated | Betting Control and Licensing Board (BCLB) | Poker not licensed; offshore sites accessible; gray area under “interactive gaming”. |

| Nigeria | Unregulated / Fragmented | State agencies (e.g., LSLGA); NLRC limited | No federal licensing; states may allow poker under general licenses; legal uncertainty. |

| Rwanda | Not offered | Rwanda Gaming Corporation | Poker requires special permission; not commonly offered by licensed operators. |

| South Africa | Illegal | NGB + 9 Provincial Licensing Authorities (PLAs) | Technically banned; widely played offshore. Court ruling (2025) reaffirmed prohibition. |

| Tanzania | Not permitted locally | Gaming Board of Tanzania | Online betting licensed; poker not among allowed verticals; players use offshore platforms. |

| Uganda | Unregulated | Lotteries and Gaming Regulatory Board (LGRB) | Legal market, but poker not addressed; offshore sites tolerated. |

Which Poker Formats Work Best in Africa?

Unlike Europe or North America, Africa doesn’t have a long-standing poker culture. There are no generational poker clubs, few televised tournaments, and limited exposure to traditional formats like multi-table tournaments (MTTs) or deep-stacked cash games. As a result, classic poker structures — full of lobby navigation, decision-heavy gameplay, and slow blind increases — often feel inaccessible to local audiences.

Angola is currently the only African country where online poker is fully licensed, making it a unique case for launching standalone poker rooms with dedicated player education and long-term brand building. In other countries, where poker may be technically possible but not explicitly regulated, operators must take a more agile route: embedding poker into existing casino or sportsbook ecosystems, using formats that are simple, fast, and mobile-friendly.

So, what works?

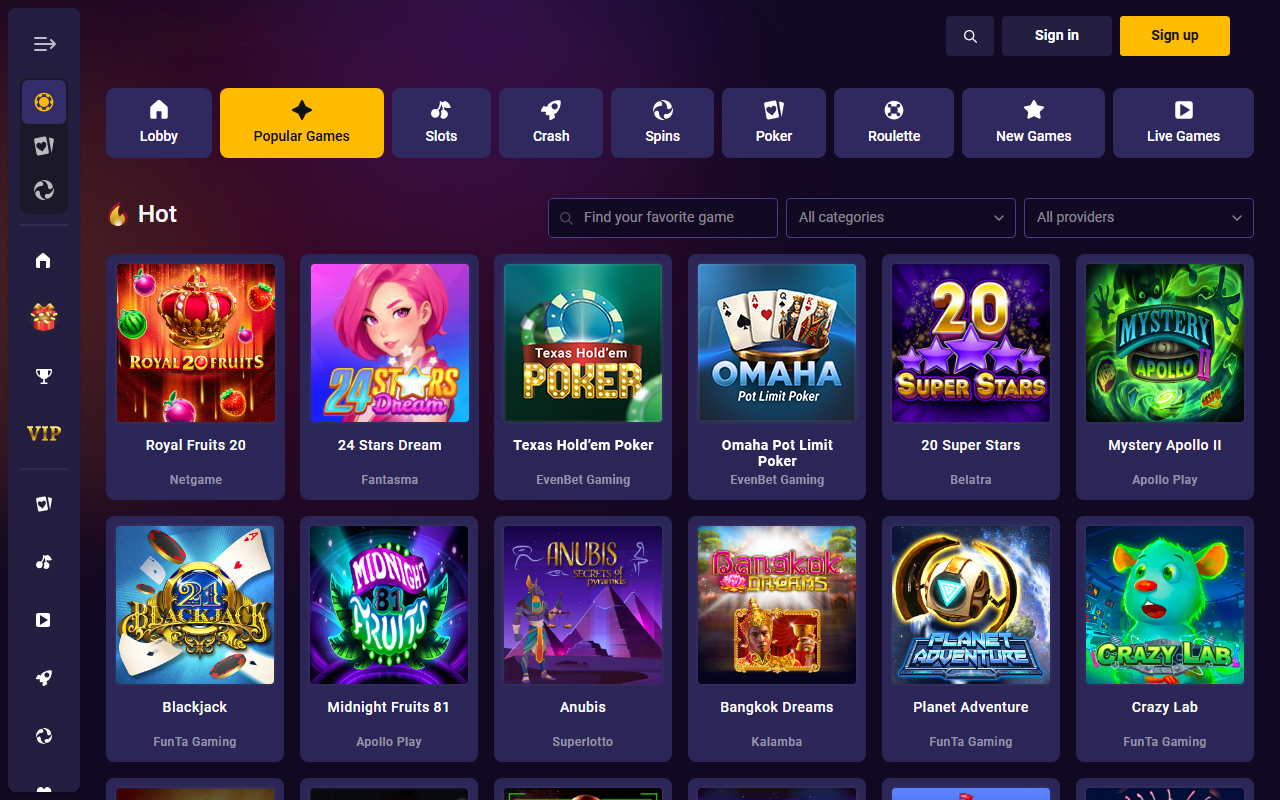

One Click Poker: Lobby-Free Poker Built for Casinos and Sportsbooks

One Click Poker is a purpose-built solution for platforms that don’t specialize in poker — think online casinos and sportsbooks. Unlike traditional poker rooms, where players browse a lobby, select their game type, and manually choose a table, One Click Poker strips away the complexity. There’s no lobby, no decision tree — just poker, instantly.

In traditional poker ecosystems, managing the balance between pros and amateurs often requires active intervention — restricting seat selection, applying fairness rules, or moderating table dynamics. One Click Poker solves that at the system level: players are dropped into appropriate games automatically, creating a smoother experience and reducing operational load.

Why this matters for Africa:

- No need for players to understand lobby mechanics or game selection

- Automatic skill-based seating helps maintain fair play without extra oversight

- Eliminates the need to manage liquidity or protect recreational players from sharks

- Visually and functionally fits inside casino and sportsbook environments

Fast-Fold Poker: Speed Over Strategy

Fast-Fold Poker — often known as “Rush” or “Zoom” — lets players instantly fold and move to a new table, skipping the wait and diving straight into the next hand. For mobile-first markets like Africa, this format checks all the right boxes — but its value goes beyond just speed.

Why it works so well:

- Delivers high engagement by generating more hands per session

- Minimizes skill gaps, making the format approachable for beginners

- Limits dominance by pros, creating a more balanced, casual-friendly environment

- Requires no player pool management or complex tournament logistics

Fast-Fold gives players the thrill of constant action without the slowdowns or pressure of traditional poker formats. And for operators, it means you don’t need to maintain a deep poker ecosystem or manage table liquidity around the clock.

This makes it ideal for embedding into sportsbooks or casinos as a low-lift, high-return poker experience — especially in bandwidth-constrained or short-session markets like South Africa or Nigeria.

Spins Poker: Casino-Like Simplicity, Poker-Like Engagement

Spins Poker — also known as “lottery Sit & Go” — is one of the most casino-friendly poker formats available, both in how it plays and how it operates. Designed for fast, low-friction gameplay, Spins looks and feels like a casino game but retains the thrill of real player-versus-player (PvP) action.

Why it works so well in Africa:

- Short, high-tempo sessions that wrap in just a few minutes

- Low skill barrier and high win potential — great for casual players

- One-click entry with no waiting or manual table selection

- Automatic seating ensures fair matchups and protects recreational users

Just like One Click Poker, Spins requires no lobby and no complex ecosystem management. It launches instantly, handles table balancing behind the scenes, and keeps user expectations aligned with familiar casino behavior: quick play, low stakes, and the excitement of variable prizes.

For African audiences used to slots, crash games, or number-based betting, Spins offers a gentle introduction to poker — without the pressure of deep strategy or long sessions. And for operators, it fits neatly into a casino or sportsbook flow, delivering PvP retention benefits with minimal operational complexity.

Conclusion

Online poker in Africa is still in its early stages — but the signals are promising. As mobile gaming, digital payments, and iGaming awareness continue to expand across the continent, poker has the potential to carve out a meaningful role within broader gambling ecosystems.

Success, however, depends on adapting to local realities. That means avoiding copy-paste strategies from mature poker markets and instead focusing on formats that match African user behavior: mobile-first, quick-session, low-friction, and easy to understand. Whether through Spins, Fast-Fold, or One Click Poker, the goal isn’t just to launch poker — but to make it approachable, sustainable, and engaging.

For operators who take the time to localize and innovate, Africa offers more than growth — it offers first-mover advantage in a vertical still waiting to be claimed.

Windows

Windows  macOS

macOS  iOS

iOS  Android

Android